Understanding the British retail electricity market

The retail electricity market is a key part of Britain’s energy system, where licensed suppliers compete to deliver power to homes and businesses.

Over the past three decades, this market has transformed from a state monopoly into one of open competition. Along the way, it has faced major challenges, including energy price shocks, supplier collapses, tighter regulation, and the urgent push to decarbonise.

This guide explains the retail electricity market. Here’s what we cover:

- What is the retail electricity market?

- How the retail electricity market works

- Retail market structure and regulations

- How tariffs are priced in the retail electricity market

- Recent developments in the retail electricity market

- Challenges the retail market faces

What is the retail electricity market?

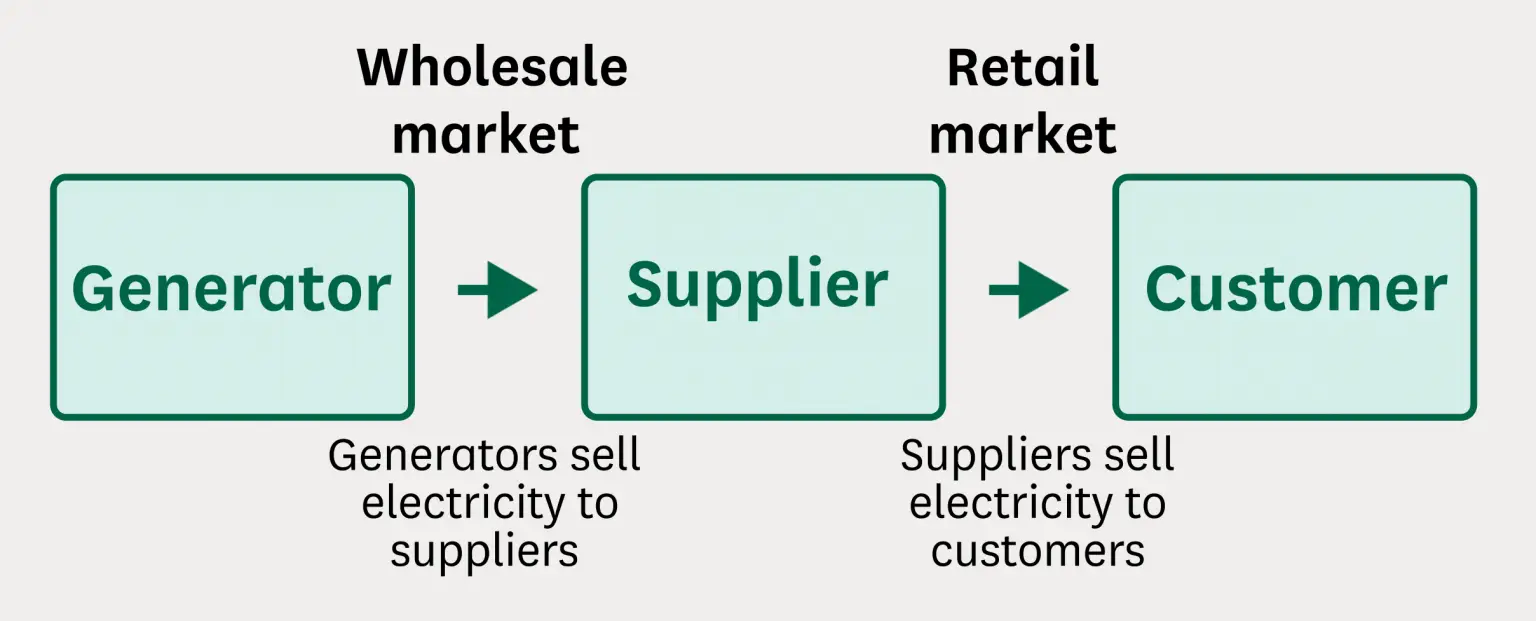

The retail electricity market is the competitive, consumer-facing part of the electricity market, where licensed suppliers sell electricity to households and businesses.

In the retail market, licensed suppliers purchase electricity from generators, then sell it to individual consumers through offered tariffs.

Source: House of Commons Library.

The retail electricity market is open to competition, meaning households and businesses can choose any licensed supplier for their energy needs.

Suppliers actively compete for customers, aiming to win loyalty and grow their market share. This competition encourages better customer service and helps reduce prices.

The liberalised electricity market explained

In the 1990s, the British electricity market went through a period of privatisation and liberalisation, which meant:

- Privatisation – Transferring key parts of government-owned energy infrastructure into the ownership of private companies.

- Liberalisation – Opening up the market to competition by removing monopolies and allowing new companies to enter and compete.

In 1990, regional electricity companies were privatised, with their shares sold on the London Stock Exchange.

Initially, these private companies were the sole electricity supplier to all properties in their region. The retail market for electricity suppliers then gradually liberalised between 1990 and 1998, with large business energy customers first getting a choice of suppliers. The market then opened up for smaller businesses and, finally, domestic customers.

The regional electricity companies were sold, merged, and rebranded over time to become the large energy supplier brands still competing today, such as EDF, E.ON, Scottish Power, and SSE.

How the retail electricity market works

This section explains how the retail electricity market fits within the wider industry and outlines the activities of individual retail electricity suppliers operating in this market.

The retail electricity supply chain

The following illustrates the entire supply chain used in Britain to deliver mains electricity to consumers:

- Generation – Electricity is generated by UK wind farms, gas power stations, and other sources by private generators.

- Wholesale market – Electricity is sold by generators to electricity suppliers on the wholesale electricity market.

- Transmission – Electricity is fed into the high-voltage national grid by generators, which transport it across the country to regional electricity distribution networks.

- Distribution – Regional distribution network operators connect the national grid to individual homes and businesses.

- Retail – Electricity suppliers sell to individual customers, managing tariff design, billing, metering, and customer service.

- Consumers – Choose a supplier and receive bills based on their metered electricity consumption.

The retail electricity market is the competitive final layer of the industry, where licensed suppliers deliver a power supply to individual customers.

Activities of licensed electricity suppliers

Ofgem licenses and regulates electricity suppliers, clearly defining their roles and responsibilities within the energy market.

Here is a summary of the key activities that enable suppliers to sell electricity to individual consumers.

Purchasing electricity

Suppliers purchase electricity on the wholesale market or via long-term Power Purchase Agreements with generators. They secure electricity purchases for future dates in order to offer fixed-rate tariffs to their customers.

Suppliers also ensure that their electricity purchases match the consumption of their customers.

Offering tariffs

Each supplier develops their own range of tariff types (fixed, variable, green, etc.). They set prices to cover costs and maintain a profit margin.

Metering and billing

Electricity suppliers collect meter reading data from the domestic and business electricity meter installed at their customers’ properties.

Suppliers use these meter readings to calculate and issue domestic and business electricity bills.

Customer service

Energy suppliers must maintain a customer service department to manage billing queries and other customer enquiries.

Ofgem requires suppliers to have processes and procedures in place to handle household and business energy complaints.

Retail market structure and regulations

This section explains the role of the market regulator and the key rules and arrangements governing the retail electricity market.

The role of Ofgem

The Office of Gas and Electricity Markets (Ofgem) is the independent regulator for the energy industry in Britain. Ofgem licenses domestic and business electricity suppliers and monitors them to ensure they adhere to licence conditions and other regulations.

Key regulations from Ofgem include:

- Supplier licence conditions – Suppliers must meet specific standards for customer service, billing accuracy, financial health, and environmental reporting.

- Default energy price cap – A prescribed maximum charge on standard variable tariffs for domestic customers.

- Financial resilience rules – Ofgem requires suppliers to maintain adequate capital and robust risk management practices.

For more information, visit our guide to Ofgem’s role in business energy.

Market arrangement and industry codes

Retail electricity suppliers must comply with a series of codes and frameworks that set out the technical, commercial, and procedural rules.

Here are the five key industry codes governing the retail electricity market:

| Code | Purpose |

|---|---|

| Balancing and Settlement Code (BSC) | Covers wholesale settlement and system balancing (administered by Elexon). |

| Retail Energy Code (REC) | Governs customer-facing processes such as switching, billing, and metering. |

| Smart Energy Code (SEC) | Provides the framework for operating the smart meter infrastructure. |

| Distribution Connection and Use of System Agreement (DCUSA) | Sets out the rules for suppliers’ use of distribution networks. |

| Grid Code | Specifies technical requirements for interacting with the transmission system. |

These codes are legally binding and may only be changed through formal governance processes involving industry stakeholders and Ofgem.

Key differences for businesses and households

Despite the grid infrastructure being identical for businesses and households, there are significant differences in how they are treated under industry rules and regulations.

Electricity suppliers are licensed separately for domestic and non-domestic customers, with the following key differences:

- Price cap – Electricity rates on a domestic variable tariff are limited by the energy price cap. Business electricity prices are not restricted by regulation.

- Cooling-off period – Domestic tariffs are protected by a 14-day cooling-off period. Business energy contracts do not typically include a cooling-off period.

- Half-hourly settlement – Energy-intensive commercial properties must have half-hourly electricity meters, which automatically record readings every thirty minutes.

How tariffs are priced in the retail electricity market

Electricity tariffs offered in the retail electricity market are designed to cover all the costs associated with providing a power supply, plus a margin for the supplier’s profit.

Here’s a summary of the underlying composition of costs within electricity tariffs:

- Wholesale electricity purchases (50%) – The cost of purchasing power from generators such as wind farms, nuclear power plants, etc.

- Network costs (20%) – The cost of using the national and regional electricity grids. Includes TNUoS, DUoS, and BSUoS charges.

- Environmental obligations (15%) – Renewable Obligation and Contracts for Difference levies that licensed electricity suppliers must pay to HMRC.

- Supplier costs and margin (15%) – The operating costs of being a supplier, including customer services, billing, metering, as well as the profit margin suppliers aim to earn.

The electricity tariffs that domestic and business energy suppliers advertise are designed to cover these costs through a combination of unit and standing charges.

Unit charges refer to the cost for each kWh of electricity consumed during the contract. Unit rates can be fixed or variable, and may depend on the time of day the power is used.

Standing charges are billed regardless of how much electricity is consumed. Domestic and business electricity standing charges cover fixed costs such as metering and supplier operating expenses.

Recent developments in the retail electricity market

Below we summarise four key developments in the retail electricity market that have occurred since 2020.

Energy price crisis 2021/22

During the energy price crisis, the cost of electricity soared due to a post-COVID surge in demand and constrained European gas supply resulting from the conflict in Ukraine.

The price rise significantly increased costs for retail electricity suppliers. Many suppliers found they could not fulfil the fixed contracts agreed with their customers and became unprofitable when charging variable tariffs constrained by Ofgem’s price cap.

Due to these financial difficulties, 30 energy suppliers collapsed, including major firms like Bulb Energy, impacting over four million customers.

In response to the crisis, Ofgem’s regulations have been amended to:

- Introduce capital adequacy rules – Suppliers are required to demonstrate stronger financial resilience.

- Energy price cap updates – The energy price cap now changes every three months (previously six) to be more responsive to wholesale price changes.

- Market entry reforms – New suppliers face much stronger scrutiny before becoming licensed.

Renewable energy products

Public and corporate interest in preventing climate change has increased considerably over the past few years.

Suppliers now compete to offer renewable domestic and green business energy tariffs.

Green tariffs are verified by Renewable Energy Guarantees of Origin (REGO) certificates, which provide proof that an energy supplier has purchased electricity from a renewable source.

Energy suppliers are also diversifying by offering additional green services, such as installing domestic and commercial solar panels and providing EV charging solutions.

Smart meter rollout

In 2011, the UK government mandated that the retail electricity market transition towards a universal network of smart meters for both homes and businesses.

Smart meters automatically transmit meter readings to suppliers, avoiding the need for manual readings and providing the industry with better consumption data.

Once the smart meter rollout is complete, the industry plans to implement a Market-wide Half-hourly Settlement (MHHS) reform, in which all meters will automatically transmit readings every thirty minutes.

Having more granular data on power consumption is expected to improve demand forecasting for suppliers and generators.

The MHHS reform is also expected to enable suppliers to offer innovative new tariffs, such as:

- Time-of-Use tariffs – Tariffs that encourage consumers to adapt their consumption to reduce electricity use during peak demand periods.

- Vehicle-to-Grid tariffs – Tariffs that allow energy suppliers to control the timing of EV charging to align with periods of lowest demand on the grid.

- Battery exports – Allowing suppliers to request exports from solar batteries during times of peak demand via a Smart Export Guarantee tariff.

- Demand Flexibility Services – Allowing households and small businesses to participate in the Demand Flexibility Service.

Market share developments

Over the past five years, there have been two key developments that have impacted the retail electricity market share.

The first is significant market concentration. The number of licensed domestic energy suppliers has halved following the energy crisis in 2022 and has not recovered. The six largest energy suppliers now control over 90% of the market.

The second trend is the rise of Octopus Energy. Founded in 2015, Octopus has expanded rapidly over the past ten years to become the largest energy supplier. Its growth has been fuelled by a reputation for excellent customer service and strategic acquisitions.

Ofgem publishes a quarterly update on market share on its retail market indicators page.

Challenges the retail market faces

The retail market in Britain faces a range of emerging challenges that are impacting suppliers, consumers, and regulators. Here, we summarise the three biggest challenges currently facing the retail market.

Affordability and fuel poverty

Current electricity prices are approximately double those seen before the energy crisis, putting many consumers into serious financial difficulty.

The retail market is under pressure to keep consumer prices low while continuing efforts to fully decarbonise the national grid.

Market interventions, such as the energy price cap, help control prices for consumers but carry the risk of further energy suppliers going out of business.

Regulatory complexity and barriers to entry

Suppliers face an increasingly complex regulatory environment, which can be particularly challenging for smaller firms.

New financial resilience regulations have also significantly raised the barrier to entry for new suppliers.

Fewer new entrants to the retail electricity market is a concern, as it reduces competition, innovation, and consumer choice.

Digital divide and smart meter rollout

The universal rollout of smart meters is increasing consumer choice but also adding complexity for many customers.

Millions of households remain reluctant to accept or use smart meters due to privacy concerns and misinformation about potential health risks.

Additionally, the rise of flexible energy services and in-home devices risks leaving behind those without access to, or willingness to use digital tools.